PreInspectR®

Inspection optimization and industry insights for better business.

Carriers realize the need to examine their property books on a regular basis, but few have the budget and personnel to inspect all of it on an annual basis. Relying on traditional attributes such as age and total living area is an inadequate method. Some data and modeling companies have developed expensive solutions that provide scores based on non-property related elements, such as consumer credit. In contrast, Millennium’s PreInspectR® is built entirely on property and geographically relevant data points.

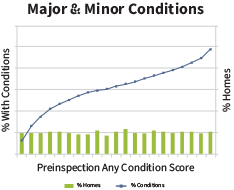

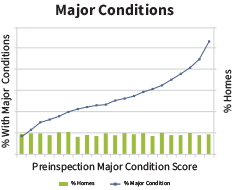

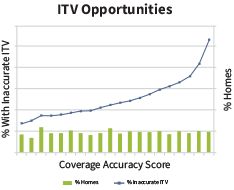

In developing PreInspectR®, Millennium analyzed over 50 factors across 6 million properties which had been fully inspected by Millennium. These factors included attributes of the home, and environmental and geographic variables for inclusion in our model, and were surprised to discover that many attributes that have long been relied upon by carriers were not the most effective at selecting risks for more intensive underwriting evaluations.

Our resulting model is highly predictive and provides three different scores that indicate the likelihood of actionable conditions, and potential Insurance To Value opportunities, all of which leverage Millennium’s inspection database, along with other relevant geospatial and environmental data.

Using PreInspectR to score a book of business is simple. All that is required are five ubiquitous property characteristics for each policy. The resulting scores guide your underwriters to those properties with the greatest opportunity for underwriting action, allowing them to achieve higher action rates, while driving lower claim outcomes, and more accurate rating and premiums within the book of business.