How can images gathered via satellite be effectively used by underwriters?

Advances in satellite imagery have increased over the past 15 years, particularly within the last several years as the technology has drastically improved the clarity and quality of images. While those improvements have made the usage of aerial imagery more acceptable in the property and casualty insurance industry, in many circumstances, such as newer or recently updated homes, or those located in less populated areas, it remains insufficient to properly underwrite a risk. The details of home construction and accuracy of conditions and hazards on a property really require boots on the ground in the form of an experienced property inspector.

Satellite images typically lack the close-proximity photos on conditions which underwriters require in order to take action, nor can they identify issues like aggressive dog breeds, trip and fall hazards, the true occupancy of a property, and issues with surrounding trees, among others.

A major concern to all carriers needs to the the timeliness of images that they are utilizing. Different aerial image distributors provide significantly different frequency of updates to their images. The two photos below are examples of the same house available through two different providers. There are a number of apparent differences that would impact an underwriter’s perspective and their determination of this h0me.

The first photo shows a much larger rear porch and a smaller living area, while the second photo has a clear addition to both the front and rear of the home, increasing the TLA, as well as an expansion of the gable roof and a decrease in the rear flat roof. Additionally the lack of clarity in the second photo makes it very difficult to see any issues with trees overhanging.

The first photo shows a much larger rear porch and a smaller living area, while the second photo has a clear addition to both the front and rear of the home, increasing the TLA, as well as an expansion of the gable roof and a decrease in the rear flat roof. Additionally the lack of clarity in the second photo makes it very difficult to see any issues with trees overhanging.

Contrastingly, in the first photo, the very clear issue with trees overhanging the left side of the home could be hiding an additional porch or any number of other hazards.

Contrastingly, in the first photo, the very clear issue with trees overhanging the left side of the home could be hiding an additional porch or any number of other hazards.

Finally the quality of both pictures make it impossible to determine the estimated life and adverse condition of the roof, the leading source of claims for insurers; that information is absolutely critical, and is only available at this point through a physical inspection.

Aerial imagery can be useful in situations where accessing the property is limited, such as accessing areas behind privacy fences, or for validating the relative wall dimensions gathered during an inspection.

Recognizing the benefits and limitations of aerial imagery is critically important for carriers to developing a successful underwriting strategy which utilizes them.

For many years, the Insurance industry has been mining data to better understand how their new business should perform and to get an actionable view into their existing Book of Business. At Millennium Information Services, we also believe in the power of data by giving our clients insight into their inspection data through our comprehensive, detail-rich property survey reports, state-of-the-art data mining and analytical tools, and valuable inspection metrics that categorize and assess property risks that can all be used to make intelligent, insightful underwriting decisions.

It begins with intelligent data. All data tells a story and specifically, property data, can give a carrier a view into the quality of new business submissions, and also provide the underwriter better insight into the condition and hazards of a property to make intelligent decisions that best follow the underwriting guidelines of their company. Millennium captures hundreds of property and risk characteristics, including home construction features, policy rating variables, and conditions, hazards, and liability exposures. This detailed property data is fed into Millennium’s Automated Property System (“MAPS”), which serves not only as a data warehouse and workflow management tool, but offers a robust, flexible set of reporting capabilities which allow carriers to easily mine and analyze their inspection data. Identified issues are referred and assigned a weighted score (“Referral Value”) based on severity and the level of the underwriting concern. The sum of these weighted scores represents the Total Referral Value for each inspection – a discreet, policy-level indication of the cumulative severity of all noted conditions. Each inspection is also assigned a unique indicator, or Stack Logic® code, based on the prioritized outcome of the inspection (e.g., types of conditions observed, occupancy status, insurance-to-value opportunity, etc.). These qualifiers transform raw inspection information into Intelligent Data from which precise underwriting decisions can be made objectively.

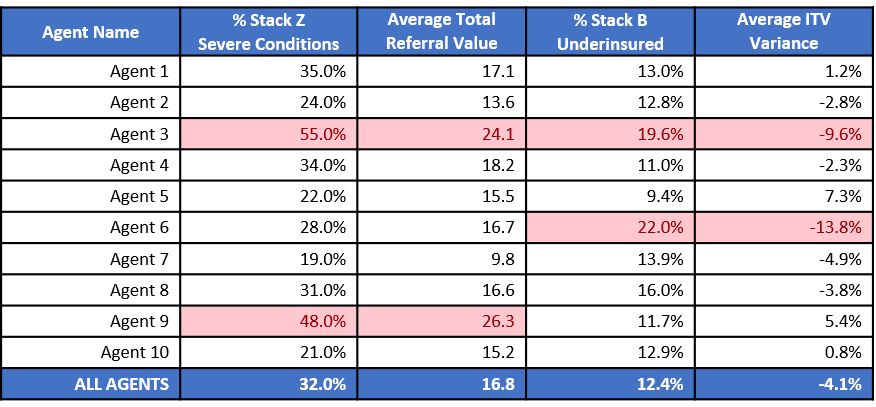

Evaluating agency performance is one opportunity that is provided through utilizing Intelligent Data. The chart below shows how, with the use of MAPS Ad Hoc reporting capabilities, a quick analysis of Stack Logic and Referral Values by Agent can be used to easily identify agents with a quality of business and/or excessive ITV deficiencies on policies submitted. Using pre-qualified, Intelligent Data allows policy quality analysis to be constructed quickly and for trends to be easily identified and monitored, long before profitability is impacted.

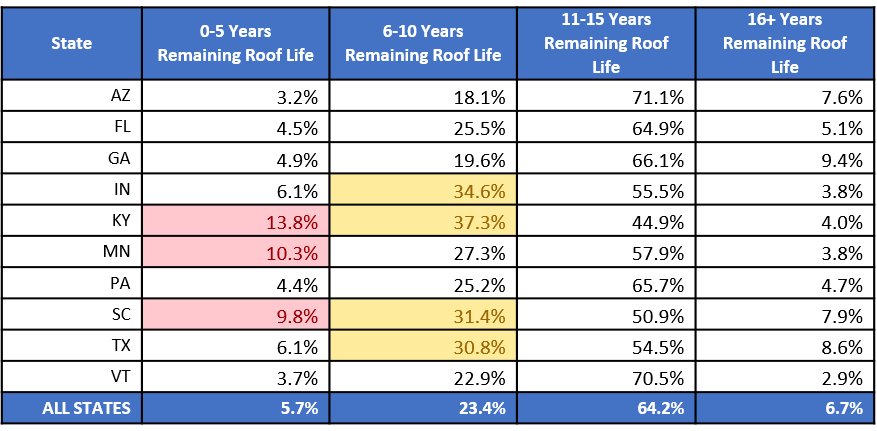

Identifying, understanding and being able to quickly respond to regional trends in conditions and hazards is also promoted through the evaluation of Intelligent Data. Roof damage is one of the most significant source of claim activity across the property and casualty insurance industry. That’s why, in addition to Stack Logic and Referral Values, we’ve developed our Roof Life Indicator. On each inspection report, along with comprehensive, detailed photo documentation, we provide assessment of the remaining roof life, broken into 4 categories, based on the observed condition of the roof at the time of inspection: 0 to 5 years, 6 to 10 years, 11-15 years, and 16+ years. Like Stack Logic and Referral Values, the Roof Life Indicator can be used not only to develop consistent action guidelines for individual risks – from roof repair/replacement to ACV roof endorsement to future re-inspection – but also to analyze the inspection book and easily identify those segments where roof age and condition issues are more prevalent. For example, take a look at the chart below showing the distribution of Roof Life Indicator by state:

With MAPS’ dynamic reporting capabilities, carriers can easily drill down below the state level and view roof life indicator results at a county, city or zip code level to identify specific geographic areas where increased underwriting focus and action may be needed to mitigate future roof losses.

These are just a few examples of how Millennium is helping carriers to manage and improve the quality and profitability of their business through the use of data and data analytics. Intelligent Data, smarter decisions – that’s the Millennium advantage.