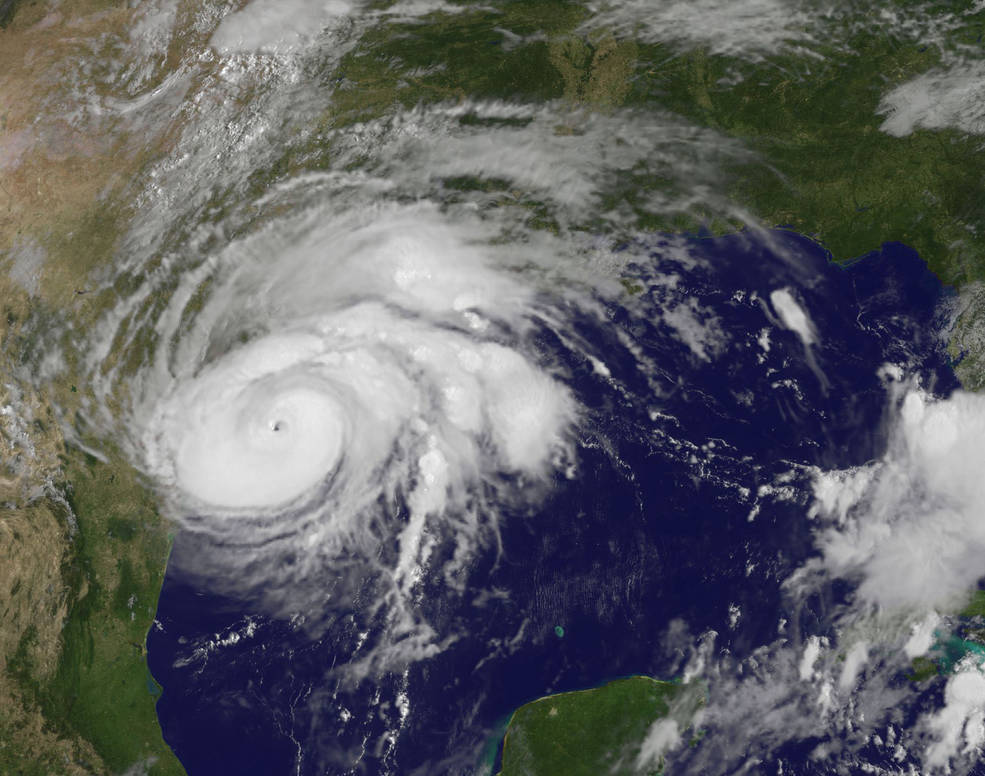

Still bearing down on the southeast portion of the country, meteorologists are calling the impact of Hurricane Harvey catastrophic. Here are a few important things to know about the storm to keep in mind.

Still bearing down on the southeast portion of the country, meteorologists are calling the impact of Hurricane Harvey catastrophic. Here are a few important things to know about the storm to keep in mind.

- As of Monday morning, between 15 and 25 more inches of rainfall is expected across the Texas coast, with isolated storm totals as high as 50 inches.

- There is also a threat of tornadoes in the coastal areas of Texas, along with the rainfall.

- Over the weekend, every major roadway in the Houston area was flooded with more than 15 feet of water in some places.

- Meteorologists have reported that the storm may even reintensify during the beginning of this week.

- The flood threat has now spread farther East into Louisiana, with as much as 15-25 inches of rainfall expected in the southwest part of the state.

- During these types of storms, contamination of clean water is a large concern. So an adequate supply of drinking water is crucial for residents in affected areas

- FEMA officials say that they are prepared to be in Houston “for years” dealing with the aftermath of Hurricane Harvey.

- As of Monday morning, more than 300,000 people in Texas were reported without power.

- The storm will most likely have a large impact on numerous agriculture sectors in affected areas, including cotton, corn, and soybeans.

To help those affected by Hurricane Harvey, Millennium has contributed to the recovery efforts in Texas through Feeding Texas and Samaritan’s Purse. You can follow the links to find out how you can help.

How can images gathered via satellite be effectively used by underwriters?

Advances in satellite imagery have increased over the past 15 years, particularly within the last several years as the technology has drastically improved the clarity and quality of images. While those improvements have made the usage of aerial imagery more acceptable in the property and casualty insurance industry, in many circumstances, such as newer or recently updated homes, or those located in less populated areas, it remains insufficient to properly underwrite a risk. The details of home construction and accuracy of conditions and hazards on a property really require boots on the ground in the form of an experienced property inspector.

Satellite images typically lack the close-proximity photos on conditions which underwriters require in order to take action, nor can they identify issues like aggressive dog breeds, trip and fall hazards, the true occupancy of a property, and issues with surrounding trees, among others.

A major concern to all carriers needs to the the timeliness of images that they are utilizing. Different aerial image distributors provide significantly different frequency of updates to their images. The two photos below are examples of the same house available through two different providers. There are a number of apparent differences that would impact an underwriter’s perspective and their determination of this h0me.

The first photo shows a much larger rear porch and a smaller living area, while the second photo has a clear addition to both the front and rear of the home, increasing the TLA, as well as an expansion of the gable roof and a decrease in the rear flat roof. Additionally the lack of clarity in the second photo makes it very difficult to see any issues with trees overhanging.

The first photo shows a much larger rear porch and a smaller living area, while the second photo has a clear addition to both the front and rear of the home, increasing the TLA, as well as an expansion of the gable roof and a decrease in the rear flat roof. Additionally the lack of clarity in the second photo makes it very difficult to see any issues with trees overhanging.

Contrastingly, in the first photo, the very clear issue with trees overhanging the left side of the home could be hiding an additional porch or any number of other hazards.

Contrastingly, in the first photo, the very clear issue with trees overhanging the left side of the home could be hiding an additional porch or any number of other hazards.

Finally the quality of both pictures make it impossible to determine the estimated life and adverse condition of the roof, the leading source of claims for insurers; that information is absolutely critical, and is only available at this point through a physical inspection.

Aerial imagery can be useful in situations where accessing the property is limited, such as accessing areas behind privacy fences, or for validating the relative wall dimensions gathered during an inspection.

Recognizing the benefits and limitations of aerial imagery is critically important for carriers to developing a successful underwriting strategy which utilizes them.