Construction costs and home prices have clearly increased in the past few years. According to the Federal Housing Finance Agency home prices rose 6.2% from Q4 2015 to Q4 2016. While that increase is in part due to a rise in building costs, evidence shows that there is also a shortage of skilled labor, particularly in the commercial construction sector.

Construction costs and home prices have clearly increased in the past few years. According to the Federal Housing Finance Agency home prices rose 6.2% from Q4 2015 to Q4 2016. While that increase is in part due to a rise in building costs, evidence shows that there is also a shortage of skilled labor, particularly in the commercial construction sector.

Many of the replacement cost companies sell indexes, or “inflation guards,” that insurance companies apply universally across their entire book of renewal business, usually by 3-digit zip code. While this seems like a logical approach to the rising costs of construction, there is simply not that kind of uniformity when it comes to property insurance.

Several years ago, when oil prices were at an all-time high, petroleum based products rose much faster than most other building material. Therefore, roof replacement costs were very different depending on the materials used. Labor in the oil patch state of North Dakota was scare and very expensive during the latest oil boom. Did the 3-digit zip adequately cover the differences in labor cost? The short answer is no. Building costs may ebb and flow, but they mostly go up. After a few quarters of applying inflation indexes, your renewal book of business could be significantly underinsured.

One way to approach this issue is with individualized inspections. The data gathered by actually going to a residential or commercial property is invaluable when updating that property’s replacement cost. These inspections not only help create the most accurate insurance-to-value (ITV), but it will also give insurers a clear and current list of conditions and hazards for each and every property. (How else can an insurer truly know whether or not a policy is worthy of keeping on the books?) Although this will provide the most comprehensive evaluation, there are practical considerations of performing a book-wide evaluation, not the least of which are the cost of the inspections and the internal resources necessary to process actionable findings.

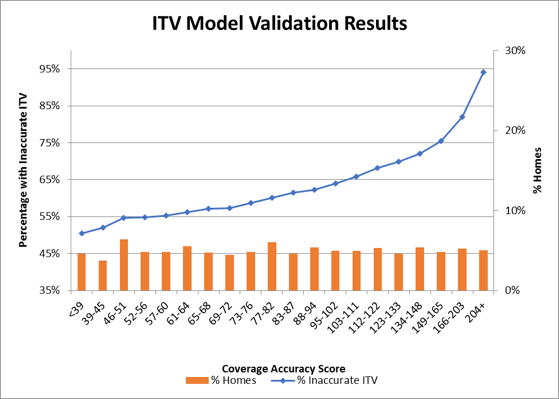

At Millennium, we understand this dilemma and that is why we’ve developed our PreInspectR® optimization tool. Our clients can utilize this tool to score an entire book of business and to focus their efforts, and expenses on those properties which are most likely have the worst conditions and hazards. Additionally, the PreInspectR® model also provides a score that identifies those properties that are most likely to have ITV issues. Depending on the level of interest in focusing on proper valuations or the existence of hazards, either or both PreInspectR® scores can be used to determine which properties should be inspected. Actionable rates for those properties inspected that were identified by a higher PreInspectR® scores can be as high as 80%.

At Millennium, we understand this dilemma and that is why we’ve developed our PreInspectR® optimization tool. Our clients can utilize this tool to score an entire book of business and to focus their efforts, and expenses on those properties which are most likely have the worst conditions and hazards. Additionally, the PreInspectR® model also provides a score that identifies those properties that are most likely to have ITV issues. Depending on the level of interest in focusing on proper valuations or the existence of hazards, either or both PreInspectR® scores can be used to determine which properties should be inspected. Actionable rates for those properties inspected that were identified by a higher PreInspectR® scores can be as high as 80%.

Our “one size does NOT fit all” approach has been well received by our clients and helps them identify properties that are either no longer an acceptable risk or that are in need of repair. It also tells them what properties are underinsured by applying the proper coverage amount, helping fund the renewal book examination and ensuring adequate coverage.

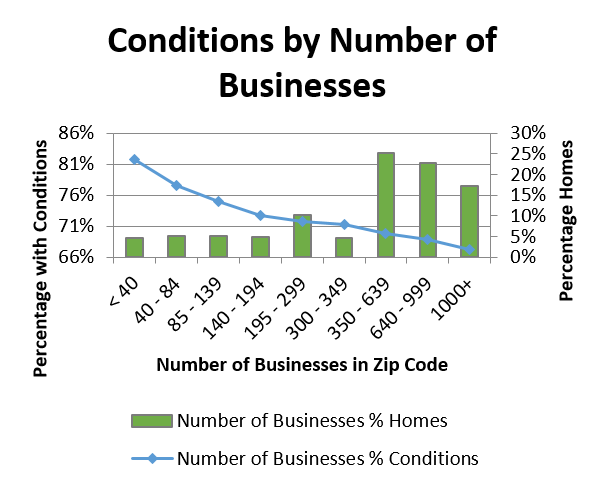

Did you know that the concentration of businesses in an area is predictive of potential underwriting concerns in surrounding homes?

We didn’t, until we embarked on the development of our inspection optimization model, PreInspectR®. We analyzed that factor, in addition to 50 other policy, home, environmental and geographic variables, for inclusion in our model scores.

We were surprised to discover that many attributes long relied upon by carriers were not the most effective at selecting risks for more intensive underwriting evaluations. Additionally, some others, like concentration of businesses (see chart below), made more effective contributions to scoring accuracy when combined with other, more predictive attributes.

All carriers need to examine their property books on a regular basis, but few have the budget to inspect all of it every year. Relying on traditional attributes like age and total living area is inadequate. Some data and modeling companies have developed expensive solutions that provide scores based on non-property related elements, such as consumer credit. At Millennium, we took a different approach. Our inspection optimization model, PreInspectR, is built entirely on property and geographically relevant data points.

Our model is built with 25 years of inspection knowledge and the use of our robust 12-million-record-inspection database, along with other geospatial and environmental data.

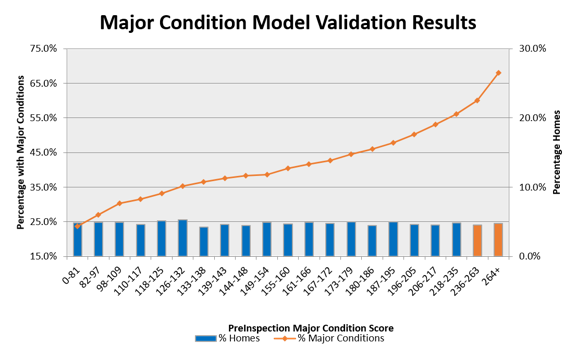

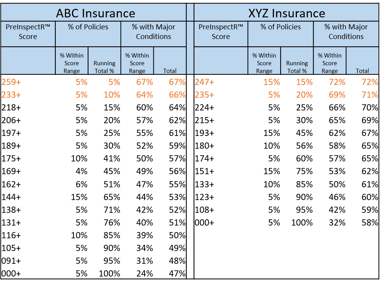

We found that the combination of these data variables in our PreInspectR model were very predictive of underwriting concerns. You can see that in the accompanying chart below, which illustrates the frequency of major underwriting concerns within score segments, each representing 5% of the population of inspections. Note, that looking at the worst scoring 10% of the book would result in an actionable rate of over 65%!

In the two real-life examples below, you will see that these companies could look at 10% and 20% of their book and have an actionable rate on Major Conditions of at least 66% and 71% respectively, based upon the PreInspectR scoring algorithm.

From an economic perspective, PreInspectR helps identify those properties that have the highest probability of having issues that need either remediation or cancellation, ensuring the avoidance of a claim in the future. It also assists in the identification of properties that have ITV issues where a coverage and premium increase is necessary to generate a healthy ROI.

The process for scoring a book using PreInspectR is simple. All that is required is five specific property characteristics from each policy. The scores produced for each property will indicate the likelihood of condition hazards and/or ITV concerns. This allows you to focus on those properties with the highest scores, which in turn will have the highest actionable rate. Using this approach, PreInspectR allows you to target a portion of your book where you can maximize the results and effectiveness of budget resources.

The process for scoring a book using PreInspectR is simple. All that is required is five specific property characteristics from each policy. The scores produced for each property will indicate the likelihood of condition hazards and/or ITV concerns. This allows you to focus on those properties with the highest scores, which in turn will have the highest actionable rate. Using this approach, PreInspectR allows you to target a portion of your book where you can maximize the results and effectiveness of budget resources.

Millennium is pleased to offer this powerful tool as part of our included service, at no fee to our exclusive clients.

Whether it’s inspection optimization models, MAPS advanced inspection workflow technology, a quality support structure, surveys or data analytics, Millennium Information Services has everything your company needs to truly understand your book of business.

Why are physical inspections vital to estimating roof life?

Through our work over the last 25 years, Millennium has developed an extensive inspection database with over 12 million property records, which we regularly analyze to identify trends in specific regions, states and local areas for our clients. One area of particular concern to our clients is roofs. You may be interested to know that we find roof issues on 16.9% of the properties we inspect nationwide.

Through our work over the last 25 years, Millennium has developed an extensive inspection database with over 12 million property records, which we regularly analyze to identify trends in specific regions, states and local areas for our clients. One area of particular concern to our clients is roofs. You may be interested to know that we find roof issues on 16.9% of the properties we inspect nationwide.

At a regional level, the South has the highest incidence of roof conditions at 22.3%, followed by the Northeast 17.9%, Midwest 15.0% and West 12.3%. Millennium provides our clients with data analyses on numerous other hazard conditions including ITV and TLA variances, tree hazards, dangerous dog breeds, unfenced pools and trampolines, uneven sidewalks and driveways, and steps and porches without railings, to name just a few.

In addition to analytical data, Millennium Information Services provides insurance carriers with a crucial element in the underwriting process for commercial, farm and residential properties: a physical inspection report. Our experienced inspectors uncover vital information about an insured premises — information that’s often invisible to the untrained eye and undetectable through aerial imagery, which, in addition to frequently being outdated and incomplete, lacks sufficient visibility of the most common hazards and adverse conditions.

Quality information is essential to successful underwriting. Profitable decisions depend on your ability to get the clearest, most detailed view of both individual properties, broader, regional issues and your complete book of business.

Millennium inspection reports provide detailed documentation on all conditions, risks and hazards observed at the property that may contribute to future loss and claim expenditures, along with a wide array of photographs of the exterior, interior and surrounding premises to convey a true picture of exposure in a property’s current condition. The level of detail we provide enables insurance professionals to make more intelligent underwriting decisions based on comprehensive, up-to-date and accurate property data.

Through our MAPS inspection workflow platform, Millennium gives our clients the ability to mine your own inspection data and conduct analysis on all of the property attributes and characteristics captured in the inspection report. Which hazard conditions are prevalent in your book of business and where are they found? Which agents are driving these quality-of-business issues? Millennium provides you invaluable data and tools to proactively manage your property business, reduce losses and achieve your growth and profitability objectives.

The bottom line is, when it comes to risk assessment and underwriting, it pays to inspect the uninspected.